Continuing from last week’s contribution on building a credit policy, we continue further down the road of building the core foundation. Once the organization has established the mission of the credit department, the next step is to get a grasp on the goals of the credit department. The goals will define the end result of what is to be achieved. For many, this is seen as probably the easiest part of putting together the policy reflecting the belief, “I want to collect this amount of billings and it must happen.” However, this mindset is seriously flawed. This is a product of an isolationist mentality, basically I can want anything, but doesn’t mean I will get it. Sadly many firms begin the year with the ‘want’ and get something seriously different.

The gap established between ‘want’ and ‘received’ is a product of external forces. The components of collecting receivables are a product of internal and external forces of the organization. They are a product of everything from culture to global economics. The first step in bridging the gap is to “know thyself,” and this is much more complex than it appears. For “thyself “is a compilation of organizational culture, as well as local, regional, national and international economics and most importantly the organization’s tolerance for risk.

One’s goal for the credit policy is to have a strong understanding of the organization’s affinity for risk; that chance of loss. The risk each firm faces can be broken down into inherent and market risk. Every client in the firm’s portfolio brings inherent risk and market risk. Market risk is very easily understood; simply look at the US credit crisis (now moving through Europe). It is the probability of default as a result of the impact of the economy. However, inherent risk drives deeper; it is the cultural make up the client, most specifically the management and culture of the client. Take for instance the airline industry, all air carriers are faced with ‘market risk’. However, how are some able to maintain profitability while others can’t – culture. Those profitable airlines have a management team and culture that mitigates their inherent risk to the market place, in light of the market condition. Inherent risk is the risk that each client brings to the market by virtue of their management culture. Thus the firm’s responsibility now rests on how much ‘risk’ (market and inherent) it is willing to bear. Essentially, how much is the firm willing to lose in taking on the engagement that is the ultimate question?

The firm’s first step is to establish how much risk it can tolerate. In simpler terms, how much is it willing to write off for the sake of getting the business? By way of a couple of examples I would like to share two firms I know personally.

The risk seeking firm is located in Los Angeles and their business is based almost exclusively on defending uninsured doctors in medical malpractice suits. According to the CFO, this is a highly lucrative business line. However, the risk of default is HIGH.

Conversely, a Washington, DC firm focuses exclusively on public relations law for the Federal Government. This practice is considerably not as lucrative; however the risk of default is LOW.

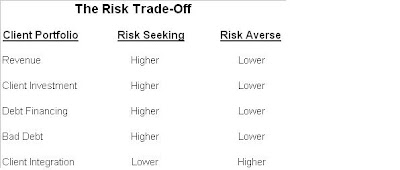

Your organizational affinity for risk is essentially a trade off of probability of loss and probability of gain. The following chart pays respect to the gains and costs related to one’s affinity for risk.

There have been countless books written on understanding your client risk portfolio. My favorite is Financial Risk Analysis, by: Jerry F. Dean, CCE. The text is definitely not for the mathematically faint of heart. Dean expounds on many complex models and their relevancy to specific industries and economic climates. However, for sake of simplicity I will present a simple model using some of the variables found in the Capital Asset Pricing Model (CAPM).

The CAPM attempts to valuate the market risk of an investment. The riskiness of the investment as it relates to the market is designated ß (beta). A ß=1 establishes standard market risk. A ß>1 relates to more risky and ß<1 equates to less risky. This model, as applied to a hypothetical firm demonstrates risk tolerance as it relates to overall market risk.

As there are many economic indicators, I have chosen Gross Domestic Product (GDP) as my standard. I would caution the use of inflation as an indicator because of the current economic climate. Let’s assume that annual GDP is 3.9%. During the firm’s budgetary process it is determined that the firm seeks a 7.5% (excluding write-off or write-down) increase in profits over the previous year. Therefore, the firm’s ß becomes 1.93; the percentage return expected by the firm over GDP. To bring this into reality, if the firm’s increased profits are $375,000 over the prior year and the risk model is ß =1.93, then the firm should feel comfortable with a year end return between -$348,750 (loss) and $375,000 (profit).

Once the firm comes to the point of being comfortable with their potential loss and the range of profit to loss, then the greatest loss amount ($348,750) or X% of billings then becomes the firm’s risk tolerance. We as a firm will lose no more than X% in the coming year. From there, the X% must be allocated over all practice groups in light of billings AND economic climate (keep in mind the credit crunch). At that point, each practice group will have their thresholds set; upper 7.5% increase in billings and not write off more than X%. The final step is to adjust the X% to a per client level to adjust for the inherent risk.

It is at this point, that the goals of the firm can be clearly documented, as the firm should be well aware of their potential costs in achieving their goal.

No comments:

Post a Comment